Let’s face it, some days are better than others. As it turns out, some weeks are worse than others. Particularly in the stock market. Let’s take a closer look.

Bad Weeks

For the record, this piece is inspired by a study done by Rob Hanna of www.QuantifiableEdges.com. The truth is what appears here may be a study of the subject that is inferior to the one Rob did originally. But I couldn’t find my copy of his original study, so for better or worse, I started crunching numbers on my own.

This study uses weekly closing prices for the S&P 500 Index going back to October 27, 1967. The Nasty 7 are the week after:

January Week 1

February Week 5

March Week 3

June Week 3

July Week 5

September Week 3

October Week 3

Note that not all of these weeks occur every year (specifically February and July only occasionally have 5 Fridays). Also, it is interesting to note that three of the weeks follow option expiration weeks (March, June and September).

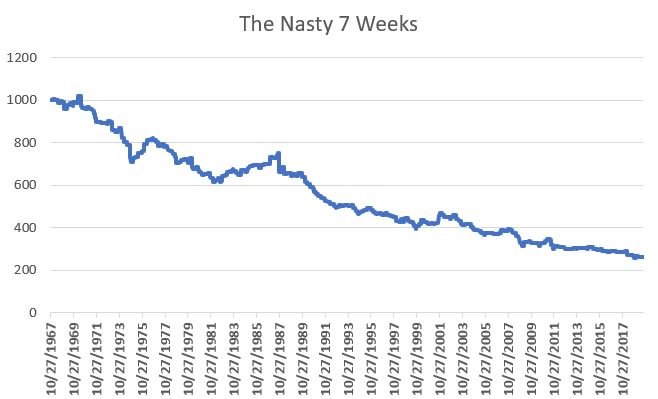

So how bad are these 7 weeks? Let’s put it this way. If you started with $1,000 in 1967 and all you ever did was buy and hold the S&P 500 ONLY during these 7 weeks every year your equity curve would look like Figure 1.

Figure 1 – Growth of $1,000 invested in S&P 500 Index only during the Nasty 7 weeks each year; Oct 1967-Aug 2019

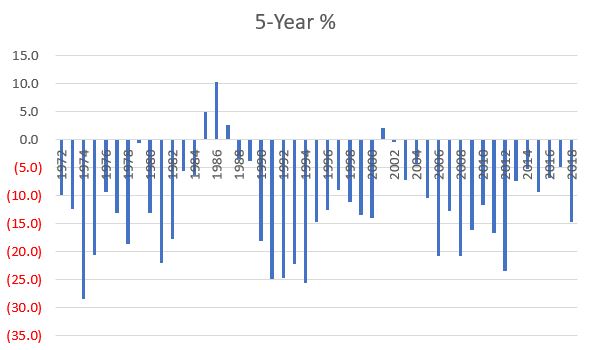

The cumulative loss from holding the S&P 500 Index only during these weeks was a fairly significant -73.7%. Figure 2 displays the rolling 5-year return from following this “strategy”.

Figure 2 – Rolling 5-year % return for Nasty 7 weeks; 1972-2019

For the record, only 4 of the 51 five-year rolling periods showed a gain.

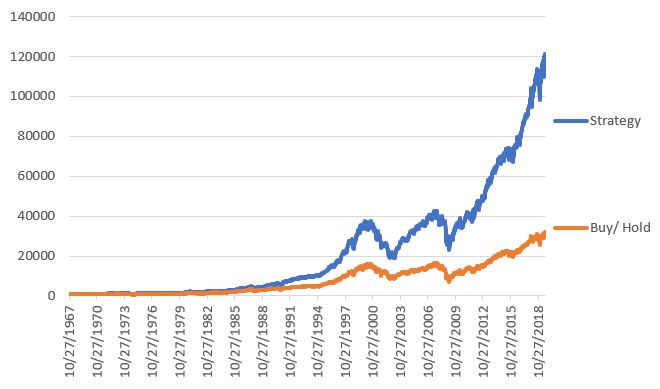

Clearly, the moral of the story is “don’t do this.” But what if we “flip it on it’s head” and do the opposite, i.e., what if we hold the S&P 500 for all weeks EXCEPT these 7 weeks each year?

The equity curve for this strategy (and for buying and holding the S&P 500) appears in Figure 3.

Figure 3 – Growth of $1,000 invested in S&P 500 during all weeks EXCEPT Nasty 7 (blue line) versus buying and holding S&P 500 Index (red line); 1967-2019

The Bad News is that you still “took your lumps” during some of the major bear markets that occurred along the way. The Good News is that $1,000 grew to $114,031 using this approach versus $29,982 for buying and holding the S&P 500.

Summary

Is this really a viable strategy? Bottom line: it’s not for me to say. I am still of that Old School journalistic “We report, you decide” mentality (as opposed to most modern journalism which is more of the “We decide, then we report our decision” modus operandi).

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Can you explain exactly what date range you mean for example by the week after july week 5 for 2019?

Dennis,

Yes, if July happens to have 5 Fridays (i.e., if the first Friday on July is the 1st, 2nd or 3rd, then there would be 5 Fridays in that month), then the “Bad” week would be the one after the last Friday in July. Hope that helps, Jay

So just to clarify, the week after March week 3 in 2019 is Mar 18 to 22?

That is correct. To clarify even more, the first Friday (or Thursday if Friday is a holiday) of the month markets the end of Week 1 – even if Friday is the 1st of the month.

Hi Jay,

To be sure to be sure…using 2019 I get the following as this year’s share of the nasty 7 weeks:

Weekending Fri 11th January

Weekending Fri 22nd March

Weekending Fri 28th June

Weekending Fri 27th September

Weekending Fri 25th October

Could I trouble you to confirm if correct?

Thanks

Lee

Lee, Yes, those weeks are correct for 2019, Jay

can’t help but say thank you

Jay,

Great article, truly thought provoking. After reading this article, I thought… what a great way to manage a 401K plan. Go from an SPX index fund to a cash fund for the nasty 7 weeks. The challenge is many 401K plans don’t allow you to flip flop in and out of funds several times a year.

With this restriction in mind, my second thought: What if we simplify this and focus on the Sept. and Oct. nasty weeks only. Specifically, what if we avoided the time frame from September’s nasty week through October’s nasty week. So for this year, we would be long the SPX up until the 3rd friday of September – 9/20/19. Then go to cash and remain in cash until the Oct nasty week passes. Then, re-long the SPX the Monday of Oct week 5 – 10/28/19. Is is possible to run a test on this modification of the strategy? I would love to see what this equity curve would look like in comparison to the 2 curves in your Figure 3.

Thanks for your time, effort, and listening,

Mike A.