JPMorgan warns of ‘fairly severe recession,’ increases credit reserves by $6.8 billion

JPMorgan Chase (JPM), the largest U.S. bank by assets, kicked off earnings season for the big banks on Tuesday by announcing that it set aside billions in anticipation of loan losses.

“In the first quarter, the underlying results of the company were extremely good, however given the likelihood of a fairly severe recession, it was necessary to build credit reserves of $6.8B, resulting in total credit costs of $8.3B for the quarter,” CEO Jamie Dimon said in his commentary.

Here were the key figures versus the expectations for the first quarter, according to analysts polled by Bloomberg.

Revenue (adjusted): $29.07 billion vs $29.52 billion expected

Earnings per share (adjusted): $0.78 vs $2.14 per share expected

The market isn’t putting much weight into how the actual results performed against analysts’ expectations as the impact of coronavirus pandemic has been extremely difficult to measure. To be sure, a key reason EPS was much lower than a year ago is because of the bank building its credit reserves.

The $6.8 billion in reserve builds “reflect deterioration in the macro-economic environment as a result of the impact of COVID-19 and continued pressure on oil prices,” the bank said in its release. Breaking that down further, the consumer reserve build was $4.4 billion, while the wholesale reserve build was $2.4 billion across multiple sectors, especially in oil and gas, real estate, and consumer and retail.

In its outlook, JPMorgan said to expect net reserve builds in the second quarter.

JPMorgan said the $6.8 billion in reserve builds resulted in a $1.66 decrease in EPS, while credit adjustments and other items in the corporate and investment bank, mostly losses related to funding spread widening on derivatives, deducted 23 cents from EPS and firmwide bridge book markdowns led took 22 cents off EPS.

Shares of JPMorgan were up 1.8% in the pre-market last trading near $99.97, but are now flat.

In an annual letter released earlier this month, Dimon told shareholders to expect earnings to be “down meaningfully in 2020” as the COVID-19 pandemic has wreaked havoc on the economy.

Like the broader financial services sector, JPMorgan entered the crisis from “a position of strength,” having posted record results in nine of the last 10 years, Dimon pointed out.

“[We] remain well capitalized and highly liquid - with a CET1 ratio of 11.5% and total liquidity resources of over $1 trillion. And JPMorgan Chase performed well in what was a very tough and unique operating environment - growing deposits in every line of business and providing loans as we extended credit and served as a port in the storm for our clients and customers,” he said in the release.

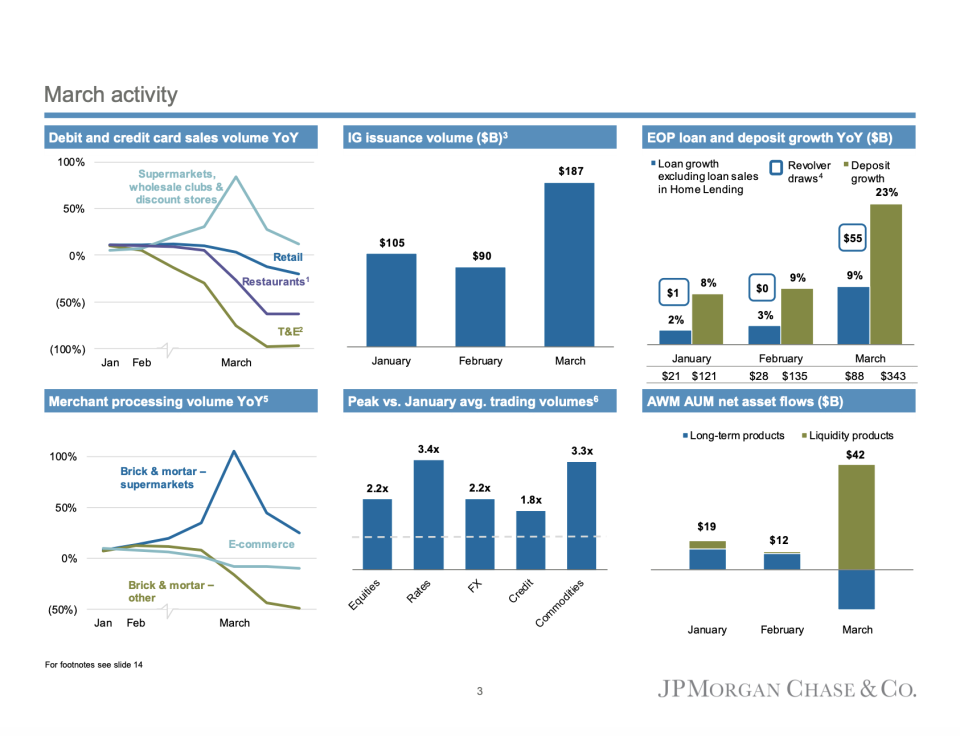

Dimon went on to note that the bank opened half a million new credit card accounts in March. The bank has actively extended credit in home lending, auto, and small businesses.

Digging further into the results, trading revenues were quite robust, with markets revenue coming in at $7.2 billion, up 32% from a year ago. Revenue from fixed income jumped 34% to $5 billion, “driven by strong client activity,” while equity trading revenue rose 28% to $2.2 billion.

—

Julia La Roche is a Correspondent at Yahoo Finance. Follow her on Twitter.