Fake news report that we would drop tariffs at trade talks with China.

Fake news report that we would drop tariffs at trade talks with China.

You called that right. The S&P is back up above 2630 and almost made 2636.

I was planning on getting back in next week hoping for good China trade news and sure enough Netflix report is low so tomorrow will be really interesting.

I sat this one out thinking I was late to the party and hoping we would get a retest of the low. On mornings like today I get up and see the futures in the red and think finally but everyday over the past 3 weeks that has happened the market (except for a couple minor day) ends up in the green.

At this point bad news doesn't matter now that the Fed has went dovish. I think the market chalks bad news be it the shutdown, earning, china (note the market didn't flinch when they came home without a deal) etc off as things are slowing and the Fed will not raise rates and will stop reducing its balance sheet.

Bad news right now means good news unfortunately and I didn't see it earlier and have missed this run. Now is hard to pull the trigger and get in since it has went up so fast.

I hear you, was looking for a pull back from the rising wedge, not sure we'll get it. I'm out of trades, can't do anything 'till the 1st.

50% S, 50% C 06 Mar, was 100% G; 80% S 20% C COB 08 Jan '24; 100% G COB 14 Nov; was 100% C COB 31 Oct (Boo!); was 100% G COB 12 Oct; was 50% C, 50% S COB 22 Jun; Life is good!

I'm really as surprised as anyone else that there wasn't more resistance at 2620. Maybe the government shutdown turned off the negatively biased algos lol

I agree, expected more than just a pause; could be momentum that carried prices past resistance. Now we're headed south, will 2620 act as support?

50% S, 50% C 06 Mar, was 100% G; 80% S 20% C COB 08 Jan '24; 100% G COB 14 Nov; was 100% C COB 31 Oct (Boo!); was 100% G COB 12 Oct; was 50% C, 50% S COB 22 Jun; Life is good!

spx 122-743a.png

Another intraday vol spike on SPX, always a curious thing when that happens. You generally want volume to pick up when the price is coming back near a trend line / resistance poin (2626), usually means the bounce is likely (not always though, no edge in the market is 100%)

Depending what happens at 2626, may dump the spxl shares or keep em.

Last edited by sniper; 01-22-2019 at 12:03 PM.

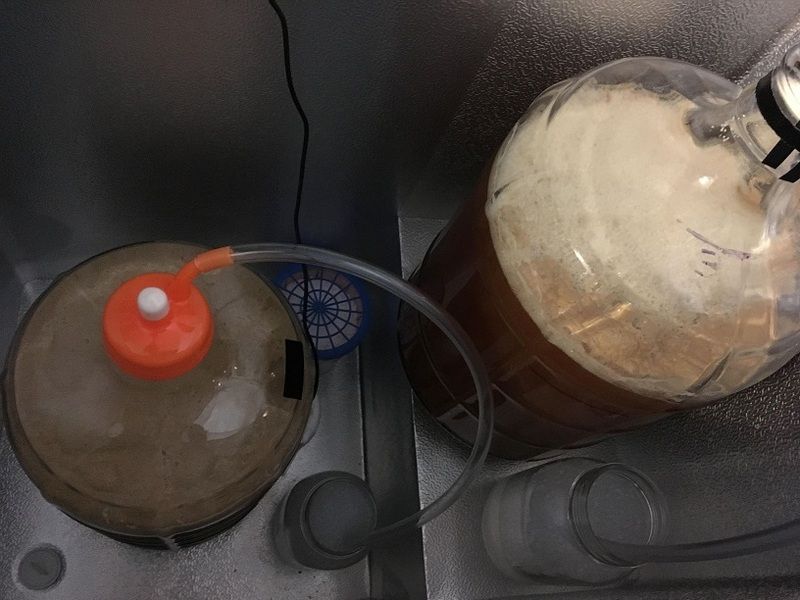

Making some good use of furlough time. A golden ale and IPA, should be ready by the super bowl

Loving it! Staying the course with the S fund, and still letting the SPXL shares ride. I think the S&P can run to 280 before meeting heavy resistance. Not to say there might not be some bumps along the way, but that's my target.

Bought some GRNTF shares a couple days ago. Went down 4% initially and up 12% todayFor that position, I'm not following my main strategy, but one that's an algorithm based strategy I'm trying out with a small position just out of curiosity. My friend said he's been using it and averaging over 70% annual returns :O I almost want to call BS but figured I'd see what's up.

|

S&P500 (C Fund) (delayed) (Stockcharts.com Real-time) |

DWCPF (S Fund) (delayed) (Stockcharts.com Real-time) |

EFA (I Fund) (delayed) (Stockcharts.com Real-time) |

BND (F Fund) (delayed) (Stockcharts.com Real-time) |

||

|

Yahoo Finance Realtime TSP Fund Tracking Index Quotes |

|||||

Bookmarks