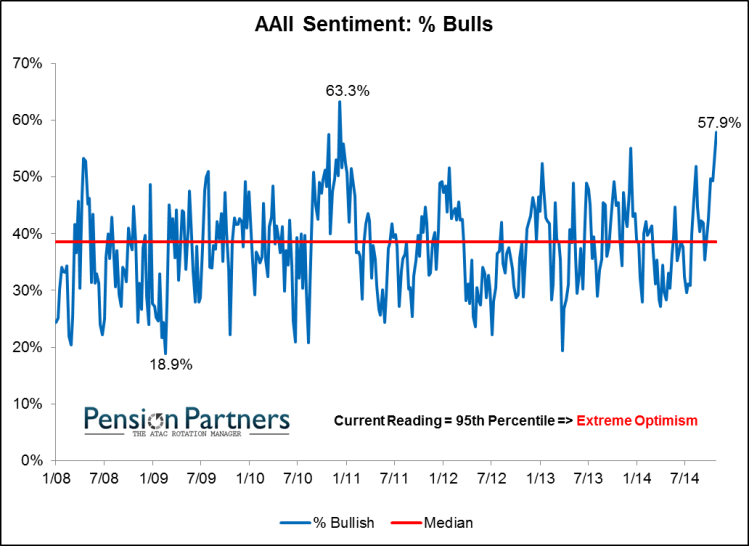

Better watch out...the "Dumb Money" is going in.

Going in from 100% G into

50% I and

50% S COB Today.

Actually only plan on this being a 1-2 day move. I agree with Tom, John Ross, JTH & others that we are way over-extended & ready for a quick snap back. It sometimes takes that long to verify, but when it does....

But I think this will wait till early next week. And I don't think it will be very serious, maybe just a 2-3% correction, then up and away into the holiday season, as our overall economy is not only on solid ground but is starting to fire up on most cylinders, along with low oil prices acting like a broad based tax cut.

So hope to garner some quick gains, but also plan on using my 2nd IFT Fri morning to go into the

F fund.

Jason had some good analysis on it here:

JTH's Account Talk

Likes:

Likes:

Show support and resistance. My comments and charts are not trading recommendations.

Show support and resistance. My comments and charts are not trading recommendations.

Reply With Quote

Reply With Quote

, with a stock market that the whole world wants to be in....which is why Cramer feels stocks will continue to punish the bears.

, with a stock market that the whole world wants to be in....which is why Cramer feels stocks will continue to punish the bears.

Bookmarks