Per Diem: Volume

by , 03-22-2015 at 12:55 PM (2236 Views)

Volume was heavy on Friday, showing conviction of the price move

___

Pre-IFT deadline vs. post-IFT deadline

- As with the overall theme of equites, the markets have tended to float up into the close

- Monday is not a great day to take an entry, is a better day to hold, and a decent day to exit

- 3rd best day to exit, the second half of the day has a 64% winning ratio with .09% average returns

___

Mondays have been picking up some steam

- SPX, 64% winning ratio with .12% average returns (last 3 closed up)

- R2K, 73% winning ratio with .17% average returns (last 4 closed up)

- AGG, 64% winning ratio with .05% average returns

___

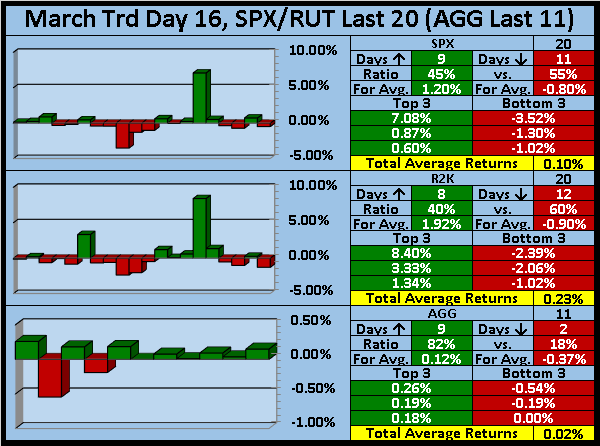

16th trading day of March, SPX/R2K have poor winning ratios but decent average returns

- SPX, 45% winning ratio with .10% average returns

- R2K, 40% winning ratio with .23% average returns

- AGG, 82% winning ratio with .02% average returns

___

AGG, Daily

- Price is up .28% over 15-Days, -.01% over 2 months and 3.99% over the past 6 months

- There is a nice rising channel, showing prices still have room for more upside

___

SPX, Daily

- Price is up .17% over 15-Days, 4.23% over 2 months and 4.81% over the past 6 months

- Nice trendline showing support, heavy volume on Friday's close, we've yet to breach the previous 52-week highs

___

W4500, Daily

- Price is up 2.30% over 15-Days, 8.18% over 2 months and 8.11% over the past 6 months

- Nice 52-week breakout, closing 5 days up in a row, strongest of the indexs

___

Transports, Daily

- Price is up 1.37% over 15-Day, 3.39% over 2 months and 5.44% over the past 6 months

- At trendline 1-2, the ascending-style triangle shows the lower highs, we need a 52-week breakout

___

NASDAQ 100, Daily

- Price is up .40% over 15-Days, 6.89% over 2 months and 8.66% over the past 6 months

- WARNING: The strong gap up could present problems if we gap down on Monday, indicative of an abandoned baby

___

Lots of spinning plates out there, Large Caps/Bonds/Dollar/Oil/Transports, ect. I've been studying the price action with laser-focus, thus far we're good, but I am looking for chinks in the armor because these markets will eventually need to retrace, the question is when? I've already posted Week 12's blog and the following week 13 is also long-term flat, but does have some big movers. This leads me to wonder when/if we'll begin to enter a consolidation phase, before a mid-April move higher. Either ways, it will be fun to see how this all plays out.

Take care…Jason